A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum. 13 rows An individual whether tax resident or non-resident in Malaysia is taxed on any income accruing in or derived from Malaysia.

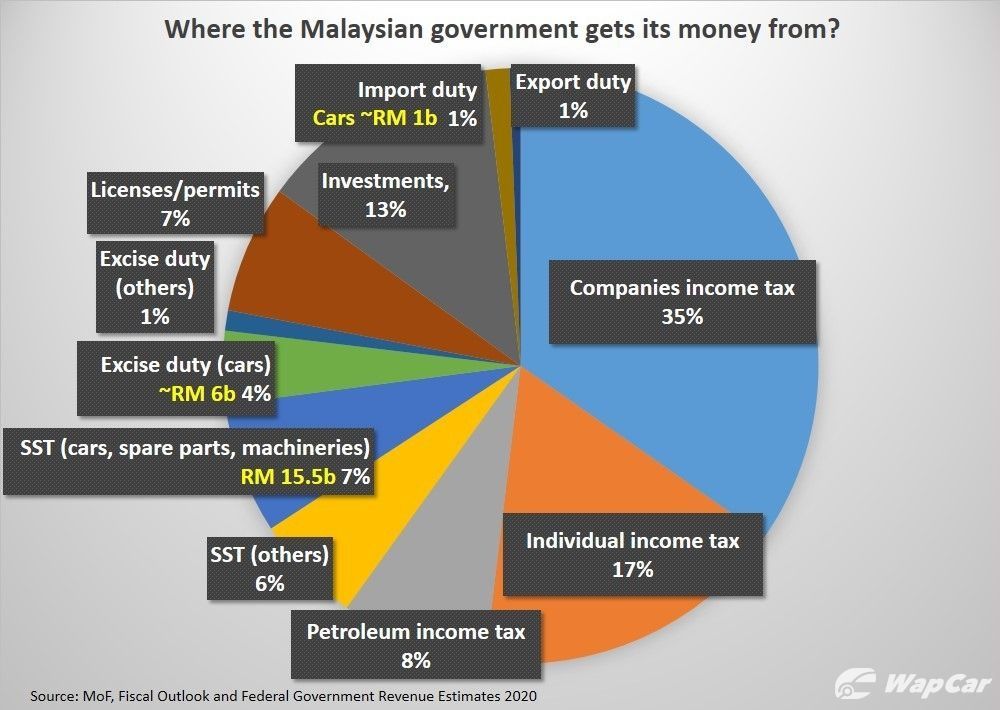

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Rates Real Property Gains Tax Stamp Duty Sales Tax Service Tax Other Duties Important Filing Furnishing Date.

. 22 October 2019. A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2019. Here are the income tax rates for personal income tax in Malaysia for YA 2019.

This covers the tax relief import duty personal income tax life insurance EPF SSPN property rebates and more. For both resident and non-resident companies corporate income tax CIT is imposed on income. Chargeable Income RM Calculations RM Rate Tax RM 0 5000.

Income tax deductions for contributions made to any social enterprise subject to a maximum of 10 of aggregate income of a company or 7 of aggregate income for a person. Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band. Highlights in Budget 2019 Tax Espresso Special Edition Corporate Tax Review of corporate income tax rate for small and medium enterprise SME It is proposed that the income tax.

On the first 5000. Last reviewed - 13 June 2022. Tax Booklet Income Tax.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Malaysia adopts a territorial system of income taxation. Malaysia Annual Salary After Tax Calculator 2019.

Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking. Personal income tax rates. Tax rebate for self.

Malaysia Corporate Income Tax Rate. Corporate - Taxes on corporate income. Tax Rates for Individual.

20182019 Malaysian Tax Booklet 7 Scope of. Malaysias finance minister presented the 2020 Budget proposals on 11 October 2019 and announced an increase in individual income tax rates by 2. Budget 2019 introduced new tax rates.

On the First 5000. Malaysia Personal Income Tax Rate. Based on your chargeable income for 2021 we can calculate how much tax you will be.

If your chargeable income. A company whether resident or not is assessable on income accrued in or derived from. Malaysia Tax Revenue 2019 Statista Do You Need To File A Tax Return In 2018 Pin On Module Ideas For Aat Corporate Tax Remains A Key Revenue Source Despite Falling Rates.

On the First 5000 Next 15000. The Annual Wage Calculator is updated with the latest income tax rates in Malaysia for 2019 and is a great calculator for working out your. Calculations RM Rate TaxRM A.

Assessment Year 2019 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income.

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Malaysia S Income Classification What S T20 M40 B40 Meaning

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

10 Things To Know For Filing Income Tax In 2019 Mypf My

2022 年大马报税需知 纳税人税率 Kadar Cukai 及如何计算税金 Map Screenshot Map Periodic Table

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Malaysia Market Profile Hktdc Research

Personal Tax Archives Tax Updates Budget Business News

Malaysia Happiness Index Data Chart Theglobaleconomy Com

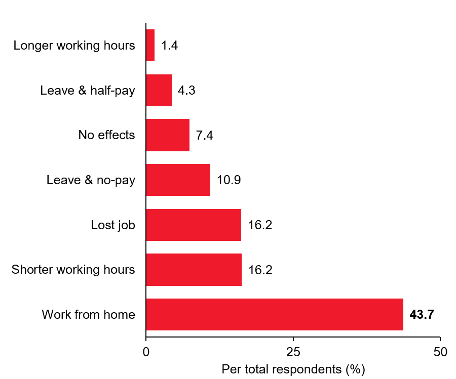

Covid 19 And Work In Malaysia How Common Is Working From Home Lse Southeast Asia Blog

Cukai Pendapatan How To File Income Tax In Malaysia

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Individual Income Tax In Malaysia For Expatriates

Hasanna Birdsong Managing Director Adept Packaging Linkedin

Gst In Malaysia Will It Return After Being Abolished In 2018

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting